As the scope of financial services widens, banks must promote their products to suitable customers. In such a highly competitive market there are a multitude of products for customers to choose from.

Effective product targeting will not only improve customer retention rates but also increase the number of additional products purchased by existing customers. However, it requires a personalized approach and a data-driven understanding of customers’ needs.

Existing or new customers – which ones bring the most value?

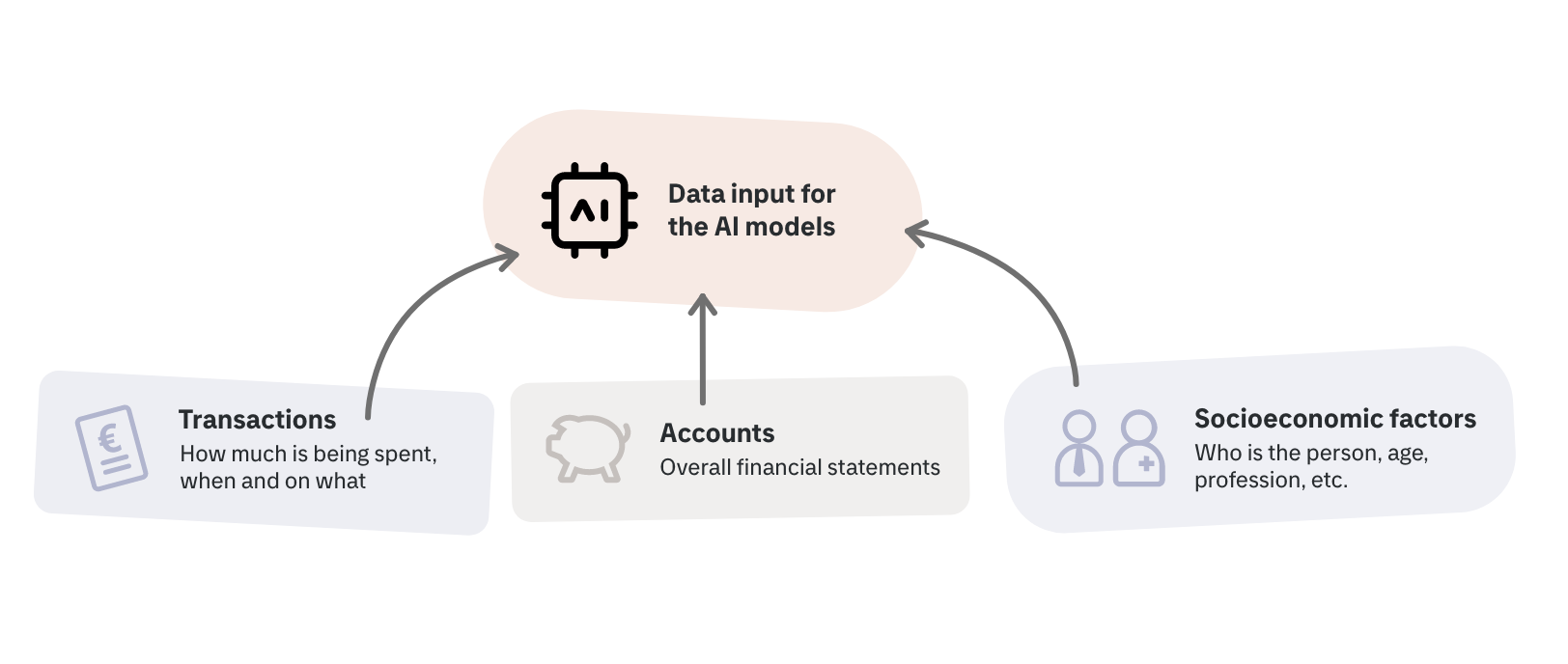

What differentiates a potential customer from an existing one or, in banking terminology, “in books”? With masses of available data, a bank can acquire highly relevant information about any individual. As a result, it has become common practice to know your customer (to some extent) from the very beginning of the customer journey. On the other hand, data is far more precious, if it is being collected while a customer is an active client. Such data allows you to analyze the customer’s behavior in relation to transactions, savings, loans, investments, etc. And it’s based on this that our recommender system can deliver significant benefits.

Figure 1. Data content in the existing recommender.

Recommender systems in a nutshell

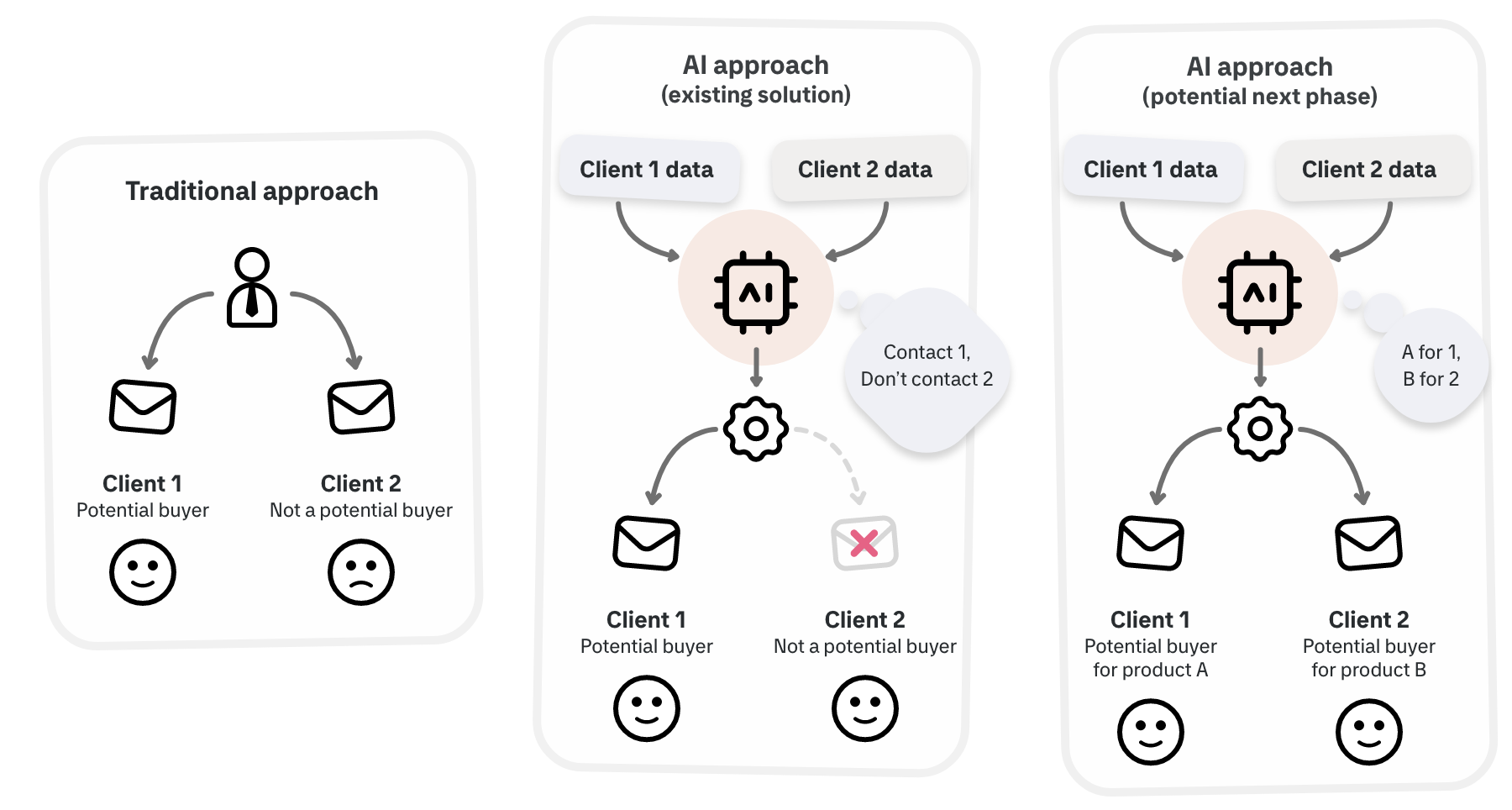

From a purely technical perspective, a recommender system is an AI algorithm that collects the available data on a customer and determines which product is the most appropriate for this specific customer at this specific moment in time. The technology has been embraced for years in various industries, especially in those where customers make purchases and consumption decisions on a regular and frequent basis, such as streaming services and retail.

Figure 2. Traditional vs AI approach in the recommender.

Huge potential for banks with the Tietoevry AI recommender system

Banks worldwide are becoming the ambassadors of developing recommender systems. Our Banking Data & AI team has collaborated with multiple banks as well to build the Tietoevry recommender system. It predicts an individual customer’s willingness to purchase a particular banking product based on existing financial accounts, transactions, and socioeconomic factors. By embracing suitable machine learning techniques, the team has managed to create a recommender system that has already brought significant benefits to banks in terms of:

- Revenue growth, with more products being targeted and sold to the right customers.

- Cost reductions, since selling to existing clients requires less financial effort compared to approaching potential clients (The European Business Review, 2021).

- Improved customer experience – particularly important in today’s highly competitive market.

Creating universal solutions with minimal entry requirements

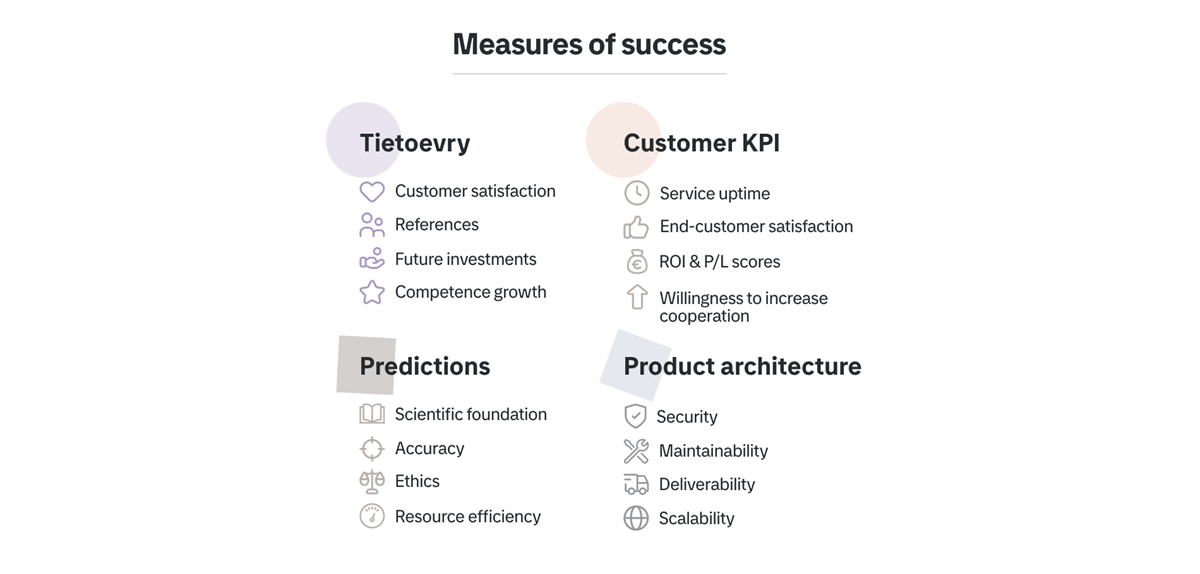

Our long-term Data & AI service goal is to continually improve our support for bank’s customers through tailored services based on their data. We are aiming at transitioning from being a provider of IT systems for simply storing and managing records to becoming a provider of platforms and products with predictive analytics and insights. This will solidify the business relations of Tietoevry and its customers at the level where both parties can gain more from the existing co-operation with no need to turn to other AI service providers to build an extra layer on the existing infrastructure.

Banks have more in common than the differences that separate them. As such, we can help banks quickly adopt this technology by eliminating high, early-stage in-house investment costs in AI systems. Instead, they can utilize proven solutions that are in use at other banks in the region.

Creating new revenue streams no longer requires years of uncertain investments in AI. Now, you can be onboarded to a functioning system that can instantly get to work reviewing existing customer behavior based on historical data. On top of that, our AI based recommender system is not only efficient and accurate but also ethical and secure.

If you want to turn your existing data assets into a competitive advantage, while improving profitability and the customer experience, or just get to know more about our AI-based solutions, contact us today and let’s talk about how we can support you moving forward.

Figure 3. Measures of success from different angles.

George is a data scientist working in the field of financial services. He has accumulated experience in banking, asset finance, leasing, and risk and portfolio management with customers throughout the Nordics.