The topic of sustainability and ESG – Environmental, Sustainability, and Governance – is arguably one of the biggest change agendas going on in Western society this decade.

The ESG topic is driven from the top by the United Nations, the European Union, and Non-governmental organizations, as reflected in a flood of regulatory agendas. At the same time, ESG has strong support from the public and consumers with a sense of being already overdue.

While enjoying big momentum, ESG brings a notation of ‘meaningfulness’ to corporates and organizations. As in all disruptions, there is clearly a possibility for actors to benefit from the change. You can choose to become a forerunner, and position favourably against competitors that are unwilling, unable, or simply too slow to adapt.

The stakes are rising. We have seen sustainability and ESG going from being communications and branding-driven topics into and an issue that boards, top management, chief risk officers and chief data officers must attend to. ESG is affecting the core operations of the enterprise, and it is directly linked to e.g., supply chain management, manufacturing, and financial decision making.

Will the ESG metrics become as important as financial figures?

ESG has come to represent how well a company is run and an indication of whether it is able to adopt to the changing reality of mankind."

,

In this article we highlight:

- Why data management is key when scaling your ESG abilities

- What to consider when ramping up data management to also cover ESG data

Is there a difference between ESG and Sustainability?

You can have good ESG capabilities – like being able to exactly break down and report on emissions – but still be a huge polluter and highly unsustainable.

Likewise, a completely carbon-neutral manufacturer with no harmful emissions might score well on sustainability, but still fail on ESG, if they have underinvested in working conditions, leading to safety incidents and staff becoming injured.

So – broadly speaking, ESG is tangible, measurable, and reportable, based on a range of different topical standards. Sustainability is the umbrella term that spans all the endeavours and intentions an organization has to reduce their negative impact on the world around them. ESG looks at how the environmental, sustainability, and governance situation impacts a company or investment case, while sustainability looks at how the company or potential investment impacts the surrounding world.

Drivers behind the sustainability and ESG strategy

ESG is a broad topic, and the drivers for organizations to engage include a mixture of

- genuine wishes to do better for the environment and society

- hopes for additional business opportunities or a favourable reputation in the market

- needs to adapt to expectations and qualifying requirements from business partners and consumers

- obligations to comply with mandatory disclosures, reporting or ESG risk management under an evolving regulatory framework.

Most companies and organizations have sustainability objectives. At present, only big companies and organizations of public interest have regulatory obligations to disclose such information and report on ESG performance. Over time we will see an increasing number of companies that must report under EU rules. It is also important to note the current difference between companies outside Europe and companies operating in the EU/EEA. Outside Europe, companies are only voluntarily driving a sustainability agenda, whereas in the EU /EEA, the ambition is to become a climate-neutral continent by 2050 and regulations are in place to make it happen.

A variety of ESG reporting obligations

Other regions of the world are also gradually ramping up their regulatory ambitions. This can lead to a fear that differences in details of definitions or ESG reporting requirements between regions/countries – while similar in nature – will make the globally active players face several sets of partly overlapping and partly differing ESG-related obligations.

People often ask, “When does the regulation come into effect?”. Well – it is slightly more complex than that!

The Global Head of Sustainable Finance at an international bank presenting the roadmap for sustainability-related initiatives and regulations implementation.

Picture by Björn Heir, Helsinki FinTech Farm -conference, March 2022

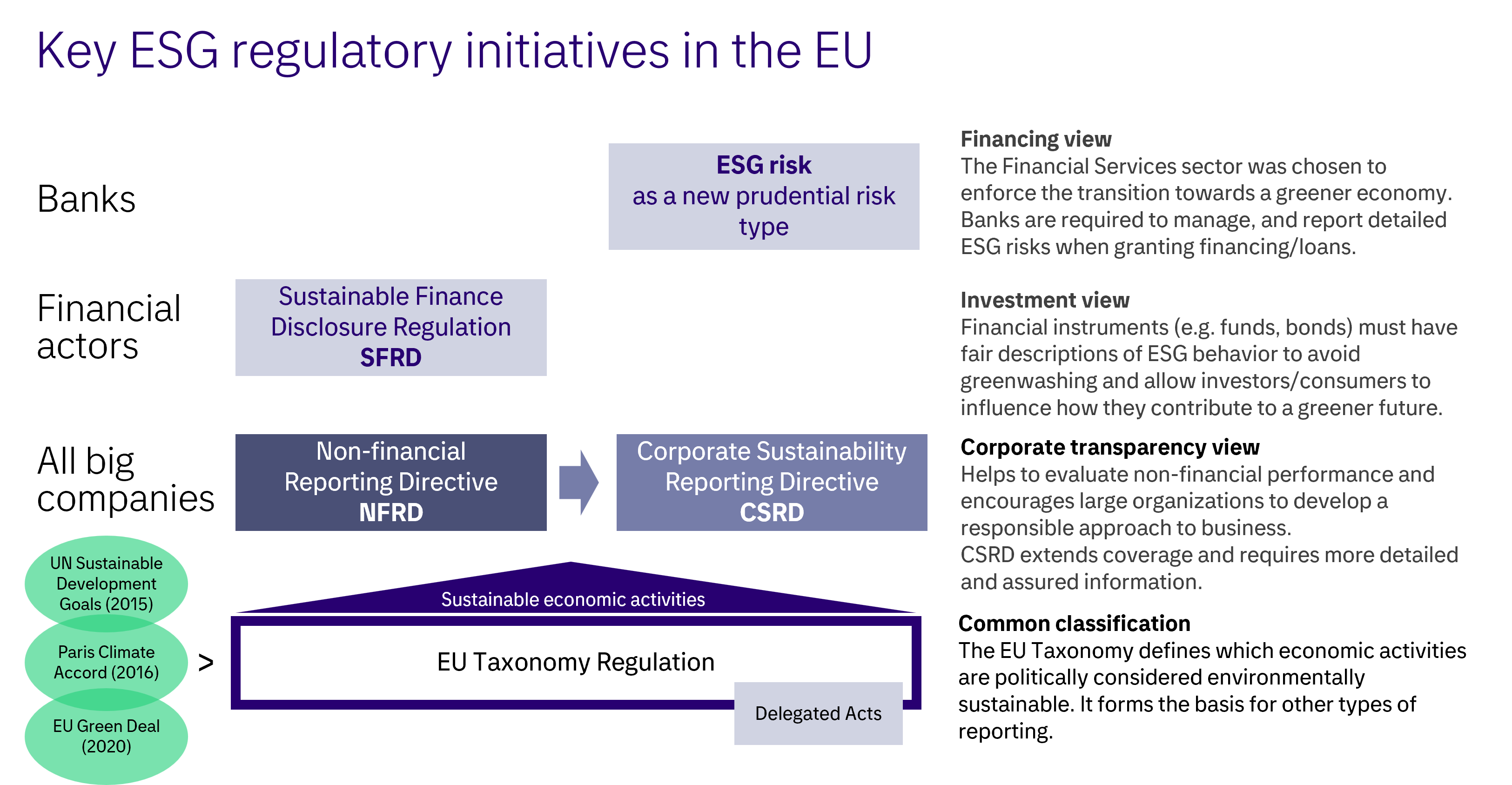

The illustration below highlights some of the main ESG-related regulations on EU level. It builds upon the EU Taxonomy regulation, which provides the common classification framework for what is [politically] considered ‘green’ and what is not. Some are currently in effect, and others are upcoming, with detailed ESG reporting requirements.

Read also: Strategic Foresight: How will EU regulatory impact Responsible AI, Data and Cloud strategies?

Key ESG regulatory initiatives in the EU. Based on the common classifications defined under the EU Taxonomy, the EU has put in place a regulatory framework. Its main objective is making Europe the first climate-neutral continent by 2050.

Due to the breadth of ESG information and sources, data management capabilities are central

ESG data often needs to be obtained from outside of the organization. This includes:

- data from the upstream value chain of raw materials

- data from a potentially high number of providers of components, services, and logistics

- data on contractors and non-employee workers

- data from downstream consumers of end products

- data commercially purchased from data aggregators, ESG rating agencies, and specialist bureaus

Externally sourced data must be normalized, so it can be combined with data from the organization’s internal processes. The internal processes, systems, and data flows are likely to need changes and extensions to allow the additional data capture and content handling needed in ESG scoring and KPI calculations.

Picture a situation, where data on climate or environmental topics – like greenhouse gas emissions, or the amounts of hazardous waste categories created as a side-effect of production – has not been part of an organization’s core data. This data is probably not handled in the company’s ERP system or product/manufacturing systems.

Or say that a company needs to find out and apply data for the fuel mix used and the average fuel consumption in inbound logistics/transportation. This data needs to be turned into CO2 emission equivalents and applied to the volumes and mix of goods manufactured at different plants. Or that consumed electric energy for powering and cooling the data centres of a cloud service provider needs to be attributed to the services a particular bank consumes. All these examples are plausible situations, where solid data management capabilities will make a world of a difference.

The times when ESG reporting could be done as a side-track or separate exercise are over!”

,

It is fair to say that a major part of the challenge related to ESG reporting sits in the data area. ESG data needs and sources are often new to the organization, and the organization is required to calculate and present figures and metrics in the organization’s name that are materially correct, externally assured, explainable, traceable, and reconciling and covering part of an entire value chain – also partly outside of the organizations’ borders. Good data management capabilities also within the ESG and sustainability reporting teams can mean the difference between order and guaranteed chaos.

ESG data forms the basis for various official reporting – as well for statements provided to customers and guidance given to financers, e.g., as part of conditions for getting loans. Unauthorized tampering with the underlying data can therefore have severe effects, far beyond reputational impact only.

Going forward, ESG reporting is expected to meet the same level of accuracy and handling standards as financial accounting, with different types of reporting being based on a consistent set of underlying base data.

It is obvious that the full range of data management capabilities available to the organization needs to also cover the ESG data domain. Ownership of ESG data must be clear and in place. Data must be under governance and quality managed, and error correction processes must be operational. In addition, a good information architecture with data catalogues and business vocabularies must be established.

How to improve your ESG data capabilities?

We work with our customers helping them to scale up their ESG capabilities. In short, we focus on:

- supporting the development journey – for data and wider topics,

- making data management more professional and

- solidifying the data flows, data sourcing processes and set-up needed for ESG reporting and for

- making internal operational use of ESG-relevant data – beyond the annual report appendices.

Often this consists of:

- Analysing the current situation, needs, and data requirements

- Assessing the data management practices applied

- Clarifying the ESG data flows, the used IT solutions/tools, and the level of automation and integration applied

- Advising and executing the roadmap toward efficient ESG data capabilities

- Application management support and execution of needed IT landscape changes to accommodate the ESG data requirements and process improvement objectives in operational systems

- Expanding the scope of managed data domains to also include ESG data and supporting the data organization in doing that

- Operationalizing data sourcing

- Helping with information architecture work and data catalogues

- Establishing and rolling-out hands-on data governance

- Building needed APIs and interfaces

- Developing sustainability reports, data hubs, and repositories

- Implementing KPI calculation engines or ESG reporting and data visualization tools

- Integrating specialized ESG platforms and tools to corporate ERP backbones

Tietoevry’s own sustainability game plan is teaching us

At Tietoevry we actively develop our own sustainability reporting and game plan to manage our impact. We are fully exposed to the reality and challenges of managing pledges and commitments, spreading awareness, finding internal sponsors, aligning roadmaps, selecting data, placing responsibilities, facing the uncertainty around interpretations of sometimes fluffy standards, and establishing the necessary ESG-related capabilities in our core operations. This in combination with customer projects brings us continuous expertise and scale to our services.

Ready to improve your ESG data capabilities?

Let’s connect.