Wealth trends 2026 — From innovation to accountability

If 2024 was defined by turbulence and 2025 by transition, then 2026 stands for measured confidence.

2026 will be about execution and accountability.

After years of uncertainty, the global wealth‑management industry in Europe and the Nordics enters a phase of structural stability – not exuberant growth, but grounded realism.

Central banks across the EU have largely tamed inflation, interest rates are plateauing, and fiscal tightening is giving way to selective stimulus in infrastructure, energy transition and innovation. Clients, meanwhile, are demanding more than returns: they expect transparency, sustainability and humanised digital experiences.

1. The era of realism – Low growth, high expectations

Economic stabilisation has settled in. GDP expansion across the EU remains moderate (≈ 1.4–1.8 %) and inflation has eased. Wealth managers are no longer chasing high‑beta opportunities; instead, they are focusing on resilient, inflation‑adjusted returns.

Infrastructure, private credit and sustainable real assets continue to attract long‑term capital – not as speculative alternatives but as anchors for stability. Nordic institutions, already pioneers in responsible allocation, now act as benchmarks for sustainable income generation across Europe.

What this means: Portfolios are built around realism, meaning steady yields, diversified exposure and transparent cost‑structures.

2. AI becomes infrastructure

The hype around AI has given way to integration. Under the EU AI Act and Digital Operational Resilience Act (DORA), AI tools now sit firmly within regulated, auditable frameworks.

From portfolio construction to risk scoring and compliance monitoring, AI has become the silent engine behind efficient, personalised advice. Generative copilots draft reports, predict client needs and translate regulatory jargon into clear language – all under human oversight.

Nordic wealth managers, early adopters of ethical AI, are setting new standards for explainability and bias testing. Though it is fair to say that compliance needs towards ethical considerations and trackability still prove a limitation.

What this means: AI is no longer a competitive advantage; it is the minimum infrastructure for relevance going forward.

3. The great wealth transfer reaches critical mass

The inter‑generational wealth transfer in Europe is expected to shift approximately €3.5 trillion over the next five years. 2026 marks the midpoint of that transfer, with Gen Y and Gen Z now actively managing family wealth.

This generation’s expectations are clear: mobile‑first engagement, social alignment and radical transparency. Advisory models are shifting from product selling to life‑goal orchestration, integrating education, sustainability, philanthropy and succession planning.

What this means: Relationships matter more than portfolios – digital empathy drives loyalty.

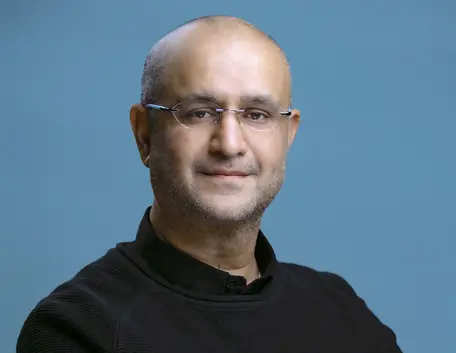

Sameer Datye from Tieto Banktech blogs about wealth and

insurance trends every year.

4. Private markets enter the mainstream

Private equity and infrastructure have matured into structured mainstream access. Under the European Long‑Term Investment Fund (ELTIF) regulation, European investors now access semi‑liquid alternative funds designed for long‑term wealth creation.

Private credit, infrastructure and renewable‑energy projects are attracting capital not only from institutions but also from affluent retail investors seeking steady income.

What this means: Alternatives are no longer 'alternative', but they are essential for balancing performance and purpose.

5. Digital assets become regulated reality

The Markets in Crypto‑Assets (MiCA) regulation is fully in force across the EU. Digital tokens, stablecoins and tokenised funds now operate under harmonised disclosure, custody and reporting standards.

ETFs tracking Ethereum and diversified token baskets are approved by several EU regulators, while Nordic custodians pioneer secure hybrid vaults combining crypto and fiat.

What this means: Institutional trust and regulatory oversight turn digital wealth from fringe to framework.

6. ESG evolves into impact and transition finance

By 2026, ESG has become measurable. The Corporate Sustainability Reporting Directive (CSRD) alongside the EU Taxonomy require verified data on impact – tonnes of CO₂ avoided, diversity metrics achieved, communities financed.

Nordic investors lead this new wave of Impact 2.0, merging green returns with social accountability.

What this means: ESG storytelling is over; 2026 is about evidence.

7. Transparent pricing and the end of complexity

Fee pressure has reached its natural conclusion – simplicity wins. Clients now expect outcome‑based or subscription models where fees align with measurable value.

MiFID updates and national regulations push firms to disclose all cost components clearly. The 'percentage‑of‑AUM' model is being replaced by transparent layers: advisory, execution and impact reporting.

What this means: The client finally knows what they pay for and why.

8. Quantum and frontier technology take the first step

European institutions are testing quantum‑inspired algorithms for portfolio optimisation and cybersecurity. These prototypes promise to revolutionise scenario analysis, derivative pricing and encryption. On the flip side, securing digital systems will become a priority for most IT system owners.

What this means: Quantum computing moves from labs to pilots – quietly rewriting the future of risk modelling.

9. Regulation as the new competitive advantage

Regulation has become a trust multiplier. Firms that embed compliance into design – AI governance, data localisation and client‑consent management – are attracting global clients seeking security and consistency.

Europe now exports digital‑trust architecture the same way it once exported industrial innovation.

What this means: Trust isn’t claimed; it’s certified.

10. Geopolitical volatility — The persistent underpinning

Despite economic stabilisation, geopolitical volatility continues to cast long shadows over global wealth dynamics. The ongoing war in Ukraine, the conflict in Gaza, and a renewed wave of trade tensions – particularly those triggered by U.S. industrial policy – have revived the spectre of economic fragmentation. The responses range from strict compliance to outright pushback, creating new complexities for multinational institutions.

European and Nordic investors remain particularly exposed through energy, commodities, and supply-chain linkages. Risk management now requires not just hedging strategies, but also geopolitical intelligence built into asset allocation and compliance functions.

What this means: Geopolitics is no longer an externality – it’s a direct variable in portfolio construction and strategic asset management.

+1: Compliance – From obligation to differentiator

As regulatory frameworks tighten, compliance evolves from an operational requirement into a defining business capability. The simultaneous enforcement of the EU AI Act, DORA, MiCA, and CSRD has elevated governance standards across the industry. Firms that embed compliance into every digital and operational layer, from customer onboarding to ESG disclosures, are not just mitigating risk; they are building reputational capital.

Automation and RegTech adoption are reducing manual oversight burdens, allowing compliance teams to become strategic partners in innovation. Meanwhile, cross-border harmonisation within the EU ensures that compliant firms enjoy smoother passporting and broader investor confidence.

What this means: Compliance is no longer about avoiding penalties – it’s about proving integrity, resilience, and long-term sustainability.

To sum up – The decade’s turning point

From 2024’s volatility to 2025’s acceleration, the industry has now arrived at a moment of proof. Every experiment, including AI, DeFi, ESG, and private markets, is being tested for reliability, scalability and accountability. Wealth managers who balance innovation with integrity will define the decade ahead.

2026 is when wealth management in Europe stops talking about the future – and starts delivering it.

References for inspiration

EY Global Wealth and Asset Management Outlook 2025

PwC “Next in Asset & Wealth Management 2025”

European Commission: AI Act, DORA, MiCA, CSRD

McKinsey Global Private Markets 2025 Report

EIOPA & ESMA updates on Sustainable Finance 2026

Bloomberg Intelligence: European Wealth 2026 Survey

Geopolitical futures: Europe’s Biggest Economies Are Weighing Down Growth

Sameer is responsible for insurance and wealth solutions. He actively promotes open ecosystem thinking that powers our WealthMapper and Insurance-in-a-Box platforms. At TietoEVRY, he has a long experience of working within the Healthcare, Insurance and Wealth domains. Prior to this, he worked as a product manager and a brand manager in the food, processing and packaging industry. He is passionate about translating technology innovations to business reality leading to better quality of human life.