A big thanks to our moderator and speakers as well as to the 700+ attendees who joined us for an inspiring and engaging event!

We were excited to kick off the year with a new webinar series for our customers and ecosystem partners.

In this first webinar, we presented the new integrated TietoEVRY Financial Services Solutions and how we use our expertise and cutting-edge software and services to help banks and financial institutions address current challenges and growth opportunities. It was a packed agenda including the latest insights from our own thought leaders and customers.

Agenda

Introduction from your host Micaela Vernmark, Head of Payments Solution Consulting, TietoEVRY

The future for financial services is digital and fast moving, with software at its core. One year ago, Tieto and EVRY merged to become a powerhouse for financial services in the Nordics. Christian will unfold how we have been able to combine our strengths from two companies and created a distinct solution portfolio aligned to meet the needs of financial institutions in Nordics and globally, today and tomorrow.

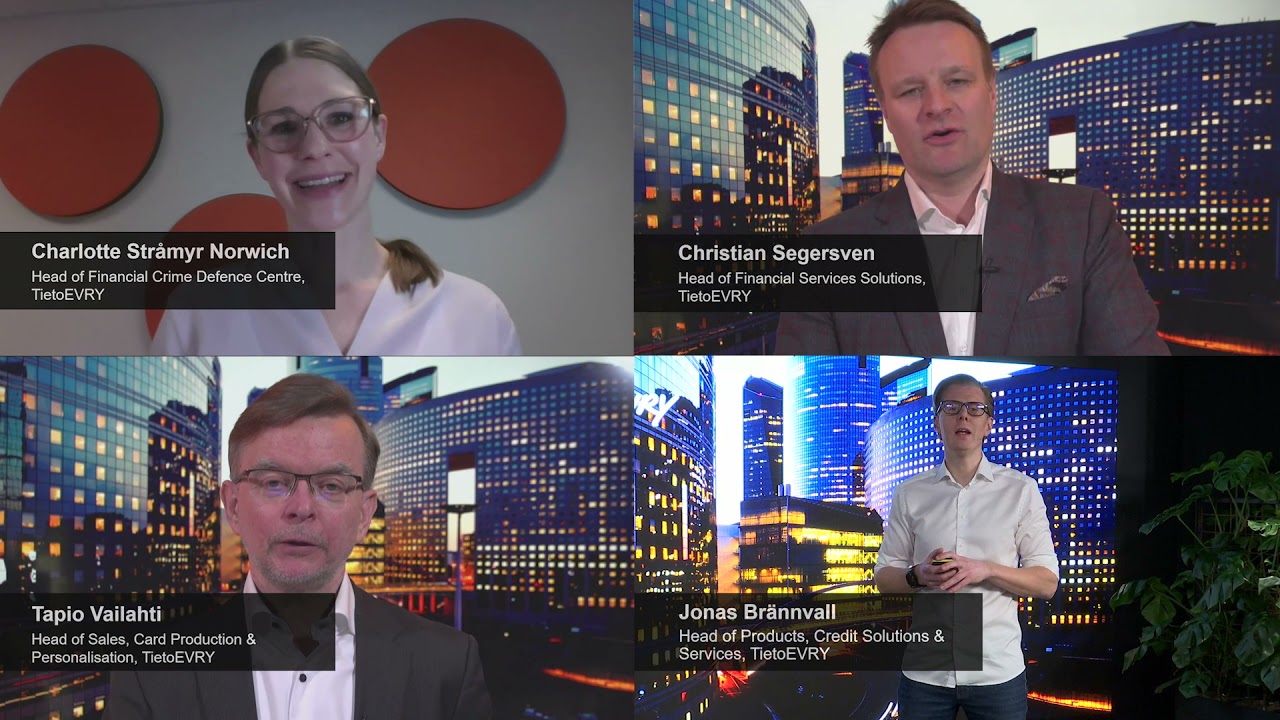

Speaker: Christian Segersven, Head of Financial Services Solutions at TietoEVRY

Deep dive into data and analytics:

- How do you work with your data

- How do you get ideas using dashboards

- How do you find invisible patterns using machine learning and artificial intelligence

Speaker: Jonas Brännvall, Head of Products, Credit Solutions & Services, TietoEVRY

Payment cards represent a daily touch point with a bank’s customers and are an effective means for communicating a bank’s brand and values. Card innovation can further provide distinct differentiation opportunities by addressing global challenges.

Tapio will discuss sustainability and pandemic concerns from a payment card perspective: How global warming can be addressed by more eco-friendly payment cards and how the spread of Covid-19 can be reduced with the use of biometric payment cards that enable high-value contactless payments.

Speaker: Tapio Vailahti, Head of Sales, Card Production & Personalisation, TietoEVRY

Guest speaker: Teemu Korte, Business Lead, Cards, OP Financial Group will share OP’s view on biometric payment cards.

Read more about OP Financial Group’s pilot on biometric payment cards

- Why collaboration is key to the success of the initiative

- What is the optimal route to P27

- How to innovate and create a better customer experience

Speaker: Micaela Vernmark, Head of Payments Solution Consulting, TietoEVRY

Guest speaker Niclas Lindblom, Senior Business Architect, Swedbank, will talk about Swedbank’s activities to prepare for the P27 Nordic Payment Platform.

Fraudulent behavior is on the rise while banks and financial institutions face an ever-increasing compliance pressure from regulators.

We will explore:

- Why cooperation is the best way to fight financial crime

- How to improve operational efficiency

- Shared cost on compliance

- How to make the most of the latest technology, such as Artificial Intelligence and Machine Learning

Speaker: Charlotte Stråmyr Norwich, Head of Financial Crime Prevention Defence Centre, TietoEVRY

Closing remarks, with guest speaker Lisbet K. Nerø, CEO of Fana Sparebank, who will share Fana's success story on how a Norwegian regional savings bank became a national success with Himla digital-only banking services.

Speakers

The Future of Nordic Retail Banking

Video is blocked

Why watch?

This webinar is for you if you are interested in:

- Retail & Corporate Banking

- Payments & Cards

- Core Banking

- Collection, Leasing, Lending and Asset finance

- Customer Experience and Digital Banking

- Financial Crime Prevention